Recap for May 30

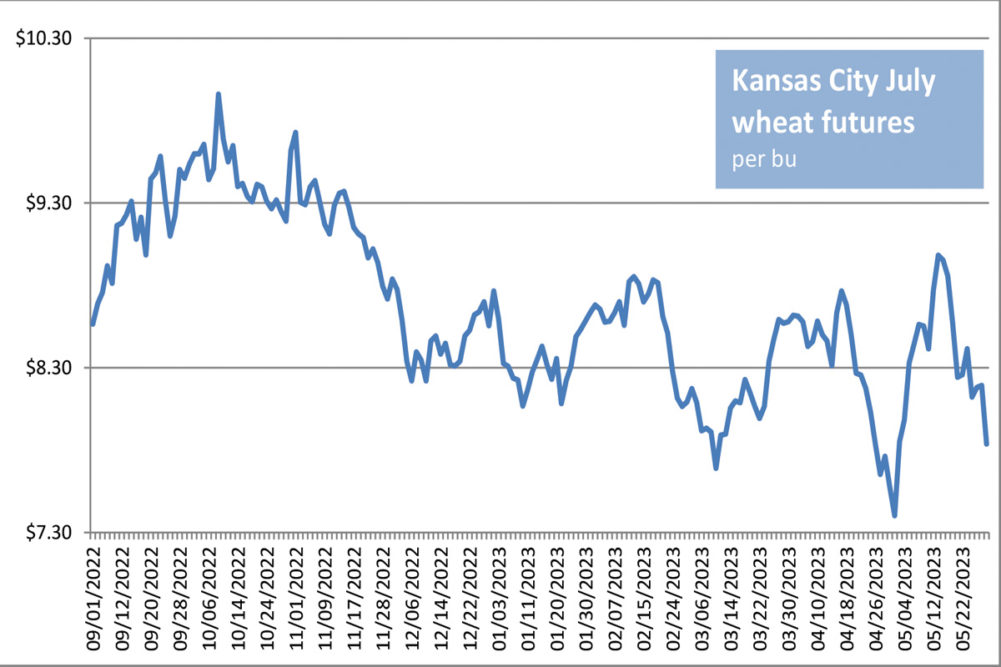

- Strong global export competition and month-end selling weighed on wheat futures Tuesday, sending all contracts lower and some to nearly 2½-year lows. Soybean futures tumbled 3% on improving crop weather forecasts for June, month-end selling and debt ceiling pact concerns. Beneficial rain forecasts sent corn lower for the first time in six trading days. July corn futures fell 10¢ to close at $5.94 a bu. Chicago July wheat shed 25¢ to close at $5.91 a bu. Kansas City July wheat dropped 35½¢ to close at $7.83 a bu. Minneapolis July wheat was down 25¢ to close at $7.93 a bu. July soybeans dropped 40¾¢ to close at $12.96½ a bu. July soybean meal pulled back $9.60 per ton to close at $392.60. July soybean oil subtracted 2.62¢ to close at 46.20¢ a lb.

- Tech stocks led a rally Tuesday that sent the Nasdaq and S&P 500 indexes higher while the Dow industrial average declined. Artificial-intelligence firm Nvidia gained 3% after trading high enough at one point Tuesday to give the company a $1 trillion market capitalization, the first semiconductor company to achieve that level. The Dow Jones Industrial Average fell 50.56 points, or 0.15%, to close at 33,042.78. The Standard & Poor’s 500 edged up 0.07 point, to close at 4,205.45. The Nasdaq Composite added 41.74 points, or 0.32%, to close at 13,017.43.

- US crude oil futures retreated Tuesday. The July West Texas Intermediate (WTI) light, sweet crude future shed $3.21 to close at $69.46 per barrel. It was the largest one-day decline since May 3 and the lowest closing price since May 4. Pressure was derived from debt ceiling deal concerns, a possible rate hike at the Fed’s June meeting, and ideas that more Russian oil could soon hit the market.

- The US dollar index continued lower for a second session Tuesday after notching a three-day rally last week.

- US gold futures continued higher as the dollar descended. June gold added $13.70 to close at $1,958.

Recap for May 26

- Grain and oilseed futures finished higher Friday in a round of short covering and technical buying ahead of the three-day weekend. July corn futures added 13¼¢ to close at $6.04 a bu. Chicago July wheat jumped 11¾¢ to close at $6.16 a bu. Kansas City July wheat edged up 1¼¢ to close at $8.19¼ a bu. Minneapolis July wheat was up 12½¢ to close at $8.18 a bu. July soybeans gained 13¼¢ to close at $13.37¼ a bu. July soybean meal added $5 per ton to close at $402.20. July soybean oil added 0.30¢ to close at 48.82¢ a lb.

- US equity markets jumped higher at the end of the week as a potential deal to raise the debt ceiling took place in Washington. The Dow Jones Industrial Average added 328.69 points, or 1%, to close at 33,093.34. The Standard & Poor’s 500 added 54.17 points, or 1.3%, to close at 4,205.45. The Nasdaq Composite added 277.59 points, or 2.19%, to close at 12,975.69 and a 2.5% rise for the week, its fifth consecutive week of gains.

- US crude oil futures on Friday bounced higher off their largest one-day decline in three weeks a day earlier as a bullish sentiment took over financial markets ahead of Memorial Day weekend on signals of economic strength and progress in debt ceiling talks. The July West Texas Intermediate (WTI) light, sweet crude future added 84¢ to close at $72.67 per barrel.

- The US dollar index weakened for the first time in four sessions Friday to close the pre-holiday week.

- US gold futures advanced as the dollar fell Friday. June gold edged up 60¢ to close at $1,944.30.

Recap for May 25

- US crude oil futures marked their largest one-day decline in three weeks Thursday after a Russian official downplayed rumors of another OPEC-plus production cut June 4. Traders said oil's bearish reaction to those comments exacerbated a negative tone set a day earlier when the government reported a massive 12.5-million-barrel weekly drawdown in US crude-oil inventories. The July West Texas Intermediate (WTI) light, sweet crude future dropped $2.51 to close at $71.83 per barrel.

- A stronger US dollar and lackluster export demand pressured corn, soybean and Chicago wheat futures Thursday, as did favorable planting weather for fall crops. Kansas City futures were mixed, but higher nearby amid continued dryness in hard red winter wheat region. July corn futures added 3½¢ to close at $5.90¾ a bu, though all later months were lower. Chicago July wheat dropped 2¢ to close at $6.04¼ a bu; later months were mixed. Kansas City July wheat gained 5¾¢ to close at $8.18 a bu; later months were narrowly mixed. Minneapolis July wheat was up 6½¢ to close at $8.05½ a bu. July soybeans eased ½¢ to close at $13.24 a bu. July soybean meal fell $5 per ton to close at $397.20. July soybean oil added 0.52¢ to close at 48.52¢ a lb.

- US equity markets were mixed Thursday. Rising shares of chip makers and other Silicon Valley companies pushed the Nasdaq higher and the information technology sector helped the S& P 500 eke out a gain, but the Dow industrials slipped in a fifth day of losses. The Dow Jones Industrial Average fell 35.27 points, or 0.11%, to close at 32,764.65. The Standard & Poor’s 500 added 36.04 points, or 0.88%, to close at 4,151.28. The Nasdaq Composite added 213.93 points, or 1.71%, to close at 12,698.09.

- The US dollar index strengthened again Thursday.

- US gold futures were lower. June gold fell $20.90 to close at $1,943.70.

Recap for May 24

- A lack of fresh fundamental inputs a day after reports surfaced of wheat imports into the country combined with rumors about Russian grain deal interference made way for a profit-taking session Wednesday, and wheat futures declines resulted. Old-crop contract strength in the cash market firmed corn futures for a second day on Wednesday. Technical buying boosted old crop soybean futures while demand concerns pressured all deferred contracts. July corn futures added 9¾¢ to close at $5.87¼ a bu. Chicago July wheat dropped 16¢ to close at $6.06¼ a bu. Kansas City July wheat descended 29¼¢ to close at $8.12¼ a bu. Minneapolis July wheat was down 21¾¢ to close at $7.99 a bu. July soybeans added 2¢ to close at $13.24½ a bu, but August soybeans were unchanged and September-forward contracts edged lower. July soybean meal fell $4.20 per ton to close at $402.20. July soybean oil added 0.24¢ to close at 48¢ a lb.

- Stock market weakness analysts said reflected increased anxiety over the ongoing debt ceiling negotiations, giving the Dow industrials index its fourth straight loss. The Dow Jones Industrial Average fell 255.59 points, or 0.77%, to close at 32,799.92. The Standard & Poor’s 500 fell 30.34 points, or 0.73%, to close at 4,115.24. The Nasdaq Composite fell 76.08 points, or 0.61%, to close at 12,484.16.

- US crude oil futures rallied again Wednesday. The July West Texas Intermediate (WTI) light, sweet crude future added $1.43 to close at $74.34 per barrel. Energy Information Administration data indicated US crude inventories fell by 12.5 million barrels, the largest one-week drop in six months. Increased gasoline demand was implied by falling US fuel inventories in the EIA data, fashioning a price-supportive tone heading into the long Memorial Day weekend.

- The US dollar index also maintained its upside trajectory on Wednesday.

- US gold futures continued lower amid the dollar’s ascent. June gold shed $9.90 to close at $1,964.60.

Recap for May 23

- Rumors that Russia was restricting Ukrainian exports out of the Black Sea despite the announced extension of the regional grain deal helped wheat futures bounce back from two-year lows and post a 2.6% increase Tuesday. Spillover support pushed corn futures higher while soybeans were under profit-taking pressure a day after posting their biggest rally in 8½ months. July corn futures added 6½¢ to close at $5.77½ a bu. Chicago July wheat gained 16¢ to close at $6.22¼ a bu. Kansas City July wheat added 15¾¢ to close at $8.41½ a bu. Minneapolis July wheat was up 11¼¢ to close at $8.20¾ a bu. July soybeans dropped 18¾¢ to close at $13.22½ a bu. July soybean meal shed $5.80 per ton to close at $406.40. July soybean oil fell 1.01¢ to close at 47.76¢ a lb.

- Shares wobbled Tuesday morning as traders followed negotiations to push forward a US default some say could upend financial markets. Lack of information on that front weighed on stocks through the afternoon and major US equity markets closed lower. The Dow Jones Industrial Average fell 231.07 points, or 0.69%, to close at 33,055.51. The Standard & Poor’s 500 fell 47.05 points, or 1.12%, to close at 4,145.58. The Nasdaq Composite fell 160.53 points, or 1.26%, to close at 12,560.25.

- US crude oil futures closed higher Tuesday after touching a two-week high ahead of a report expected to show weekly declines in US inventories of crude oil, gasoline and diesel fuel. The July West Texas Intermediate (WTI) light, sweet crude future added 86¢ to close at $72.91 per barrel.

- The US dollar index strengthened Tuesday.

- US gold futures eased as the dollar turned higher. June gold subtracted $2.70 to close at $1,974.50.